3 Mortgage Scams to Be Mindful Of

Buying a new home is one of the most exciting times in your life, and it’s one of the most significant investments you’ll make. With that in mind, it’s important that you avoid any potential mortgage scams since you’re working with a hefty amount of money. Unfortunately, these types of scams can be prevalent, but if you know what to look for you can easily avoid these situations! Below, we’ll highlight some of the most common mortgage scams and how to avoid them.

Buyers: Wire Transfer Scam

When closing on your new home, your lender will ask you to wire funds, including your down payment and closing costs. The lender will send you specific details for wiring these funds and it’s important to pay close attention to the instructions to avoid being scammed. In this scenario, a scammer could email you, stating that there’s been an update to your closing and provide alternative instructions for completing the wire. The best thing you can do to protect yourself is connect with your loan officer or settlement agent directly to confirm details before wiring any funds.

Buyers: Everyone Qualifies

If you find a lender who proudly boasts that everyone qualifies, no matter what your credit score is, be very cautious. If it sounds too good to be true, it most likely is! As a homebuyer, you’ll want to have good credit before applying for a mortgage, as the better your credit, the better the terms you should receive. If your credit needs some work, your mortgage rate may be higher, so don’t allow a lender to swindle you into a deal without doing your homework. A good lender will stress the importance of good credit and will be willing to help you get to a point where you want to be before plunging into homeownership!

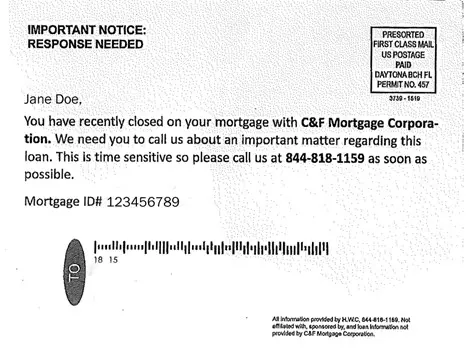

Owners: Print Mail Disguised as Your Lender

Once you close on your mortgage loan, some of the information related to the transaction is registered as public information which is a prime target for scammers. Scammers may send a “high importance notice” to the borrower and may even list the name of your Lender and your loan number. The goal of this tactic is to get you to call or communicate with the scammer to gain access to your funds. It is important to review the fine print as most of these notices explicitly state that the lender they are impersonating did not initiate this communication. When in doubt, ask your lender to review the communication to validate it.

Sample print mail scam:

Having a great lender in your court is key to avoiding these and other mortgage scams. If an offer seems too good to be true, it probably is! At C&F Mortgage, our focus is on you. Our loan officers are here for you from start to finish, and every step in between on your home buying journey. Get in touch with us today to learn more.